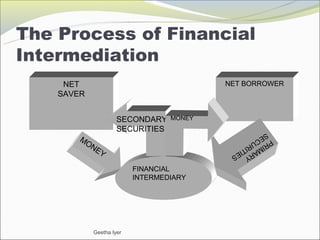

Describe the Process of Financial Intermediation

We are not concerned with optimizing behavior but merely with the nature of assets and liabilities. The process of financial intermediation occurs with depository non-depository and investment intermediaries.

Financial Intermediation Process Download Scientific Diagram

A financial intermediary is a firm or an institution that acts an intermediary between a provider of service and the consumer.

. The case for financial intermediation rests on two premises. The key to understanding the process and the range of financial instruments available lies in recognizing that economic agents are a heterogeneous bunch having very different financial positions investment. On the nature of financial intermediation a distinction is made between brokerage and qualitative asset transformation.

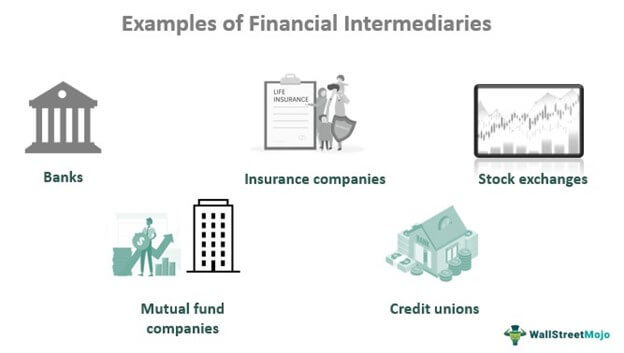

A financial intermediary is an entity that acts as the middleman between two parties in a financial transaction such as a commercial bank investment bank mutual fund or. To fully evaluate the importance of this process we will explain the five theories of financial intermediation and discuss the main benefits of financial intermediation. Financial intermediation reduces costs encourages efficiency and ensures contractual.

The Financial Intermediaries Analysis FIA section provides analysis to policymakers and engages in research projects on. It is the institution or individual that is in between two or more parties in a financial context. - But in an Arrow-Debreu complete markets world financing of firms and governments by households occurs via.

These entities help people and institutions access money. This chapter analyzes the nature of financial intermediation and discusses the variety of financial intermediaries FIs that exist. Financial intermediaries are commercial banks mutual funds credit unions stock exchanges insurance companies and other financial institutions that help in the growth process of the economy.

Become a member and. So the viewpoint of this paper is that financial intermediaries are not a veil but rather the contrary. Transactions cost transformation - through economies of scale and specialism - reduce search verification monitoring and enforcement costs - provide a convenient safe location forum in which to transact.

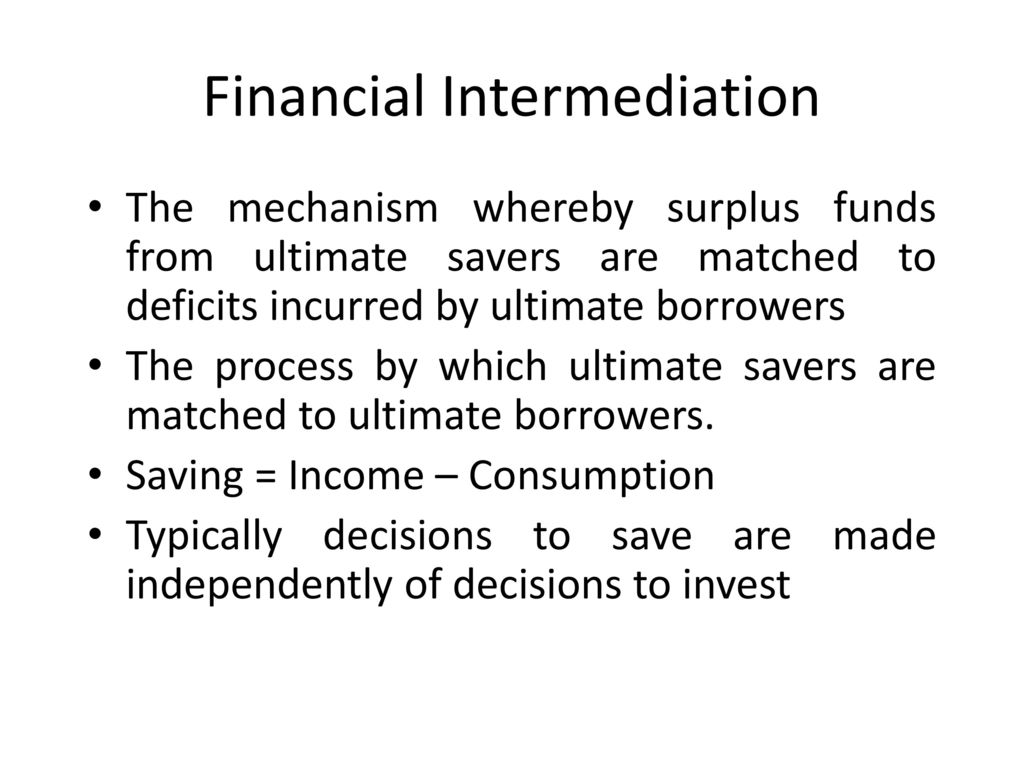

Financial intermediaries are highly specialized and they connect market participants with each other. The process of financial intermediation involves channeling money from people who have excess funds savers to people who need extra funds. Financial intermediation is a business model that facilitates financial transactions between savers and borrowers.

Financial intermediation is the process of transferring sums of money from economic agents with surplus funds to economic agents that would like to utilize those funds. Financial Intermediation is the process in which financial institutions take in funds from depositors also referred to as the ultimate lender and then lend a large proportion of the funds to prospective borrowers. This chapter analyses the nature of the intermediation process the qualitative properties of the loans and deposits supplied and their determinants.

The nexus between the evolving nature of financial intermediation especially in the so-called shadow banking sector and the transmission channels of monetary policy. Depository financial intermediaries FIs and nondepository FIs. A financial intermediary is a financial institution such as bank building society insurance company investment bank or pension fund.

Borrowers want to put money to work by investing in assets or a business. See full answer below. Download scientific diagram The process of financial intermediation as applied to housing investment with a guarantee from publication.

Basically financial intermediation is the root institution in the savings-investment process. The interest rates are given. Remembering the Good Old Days Broadly speaking intermediaries facilitate the transfer of capital and risk between borrowers and savers.

Simply put a financial intermediary is an entity that helps connect people and institutions that need money with those that have money. Financial intermediation beyond the banks. In theoretical terms a financial intermediary channels savings into.

Financial intermediaries take deposits from a large number of clients and lend money to multiple borrowers in this way they maintain economies of scale. Intermediate between providers and users of financial capital Besides banks - pension funds insurance companies securities firms differ in terms of assets. Ignoring it would seem to be done at the risk of irrelevance.

A financial intermediary is an entity that facilitates a financial transaction between two parties. Recent developments PDF 5099 KB The New Zealand financial system is dominated by banks whose assets are well over 90 per cent of those of all deposit-taking institutions. Process of financial intermediation cont.

Some examples of financial intermediaries are banks insurance companies pension funds investment banks and more. A financial intermediary offers a service to help an individual firm to save or borrow money. The various FIs discussed include.

A financial intermediary helps to facilitate the different needs of lenders and borrowers. Such an intermediary or a middleman could be a firm or an institution. A few financial intermediaries examples are commercial banks insurance companies pension funds financial advisors credit unions and mutual funds.

A financial intermediary means an institution that acts as a middleman between two parties in order to help financial transactions. The provision of credit and leverage in dealer-intermediated. Banking groups also own fund management businesses with more than a quarter of all funds under management.

Savers want to securely store value and earn a return that protects funds from the effects of inflation.

Modes Of Financial Intermediation Download Scientific Diagram

Chapter1 Financial Intermediary

Financial Intermediary Definition Role Types Examples

Financial Intermediation Ppt Download

Financial Intermediation Process Download Scientific Diagram

The Process Of Financial Intermediation As Applied To Housing Download Scientific Diagram

The Process Of Financial Intermediation As Applied To Housing Download Scientific Diagram

Aht News And Activities From The World Of Agile Knowledge Management Knowledge Management Knowledge Management System Agile Development

Comments

Post a Comment